The issues Eastern European and Central Asian lessors are experiencing reflect industry growth pains, while the U.S. is experiencing maturity pains according to Adam Warner, President of Key Equipment Finance.

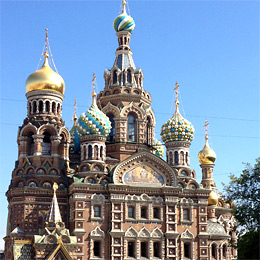

On May 29 and 30, Euromoney Seminars sponsored the 30th Annual World Leasing Convention in St. Petersburg, Russia, bringing together lessors and lessees from around the world to take part in a comprehensive review of the global equipment leasing market.

Equipment finance experts were invited to make presentations at the event covering a variety of topics affecting the equipment finance industry internationally including – key trends and developments in the market, the pace of the global economic recovery, Basel III, strategies on improving the value propositions presented by lessors, a review of emerging versus mature leasing markets, and the latest on the proposed lessor and lessee accounting changes.

Among the presenters at the conference was Adam D. Warner, President of Key Equipment Finance and Vice Chairman for the Equipment Leasing and Finance Association’s (ELFA’s) board of directors. Warner was selected to present an overview of the United States equipment leasing and finance industry and his insights into the U.S. equipment finance market. Additionally, Warner’s presentation provided a summary of ELFA’s mission, a review of the Monthly Leasing and Finance Index, a discussion on the U.S. economic outlook and factors affecting the economic recovery, regulatory compliance and impending lease accounting changes.

Upon Warner’s return from the conference, Equipment Finance Advisor spent some time with him to gather his perspectives and insights gained from his trip abroad. One of Warner’s immediate observations about the conference was that while it was certainly attended by representatives from around the world, the main contingency came from Eastern European and Central Asian countries, which provided him with an interesting perspective of the leasing industry in those regions.

The U.S. Equipment Finance Market

The U.S. equipment finance market has been described as continuing to strengthen, but at a slower than desirable rate. This is evidenced in the most recent ELFA data, which demonstrated some positive signs within the equipment finance industry – with numerous challenges remaining. According to ELFA’s May 2012 MFLI-25 report, the U.S. equipment finance sector has experienced a 16% rise in new business volume year-to-date, while May borrowing activity was up only 1.6% versus April. And, compared with a year earlier, May borrowings were up 10.7%, however this growth has been attributed mainly to the financing of replacement equipment.

Meanwhile, the Equipment Leasing and Finance Foundation's Monthly Confidence Index (MCI-EFI) for June 2012 was 48.5, down sharply from the May index of 59.2, reflecting growing concern about the pace of U.S. economic growth, U.S. unemployment, the European debt crisis, and regulatory uncertainty.

With this U.S. data as the backdrop, we asked Warner for his observations from the conference and about the industry abroad.

EFA: How would you describe the general “tone” of the conference attendees, and which topics were of most interest to the attendees?

Warner: The tone would probably be best described as inquisitive. Many of the attendees were clamoring to gain insights and information about what is happening in the U.S. and Western European equipment finance markets – with a focus on understanding how the more developed leasing markets are functioning. Overall, the attendees seemed less concerned about general economic issues, and more about the operational aspects of running an efficient leasing company.

Many of the attendees seemed to be grappling for all types of information, with a primary focus on understanding how the U.S. leasing market had matured – both from a commercial perspective and perhaps even more importantly, an operational perspective. There were many questions about the operational platforms equipment leasing and finance businesses are using in the U.S. and Western Europe with specific questions focused on operational software applications.

EFA: How would you describe the equipment finance industry in Russia – the host nation and largest geographic country in the world?

Warner: Russia seems a lot like the U.S. leasing market about 40 years ago – back in the early 1970s when our industry had a lot of entrepreneurial people trying to find ways to make leasing an effective commercial finance tool, while also working with the government to craft laws and regulations to make leasing more commercially effective. So if you think about the U.S. leasing market in the early 1970s – when leasing was this novel idea that was really growing into an industry – that describes the Russian leasing market. There are some very bright and interesting people working hard to try to find how to make leasing work in Russia.

EFA: Were the impending changes in lease accounting of major concern to the attendees? If not, what other issues seemed prevalent?

Warner: There was certainly a lot of curiosity about where the lease accounting standards will eventually land, but the attendees from Eastern Europe and Central Asia seemed less concerned with lease accounting changes and more concerned with how to develop new leasing opportunities and effectively build the operations side of their businesses.

The attendees were also very interested in learning about the asset classes Western European and U.S. lessors are most interested in financing. For example, in Russia and the surrounding region, transportation equipment – tractors, trailers, rail and aircraft – are by far the biggest driver of their leasing activity. Conversely, medical equipment and IT financing are not main staples of the industry.

Author’s Note: A March 2012 study conducted by Asset Finance International in association with CHP Consulting entitled Russia: An Overview of the Leasing Market certainly supports this observation. According to this study, railway stock and machinery, commercial vehicles, air transport (helicopters and aircraft), and light motor transport represented a 71.4% share of segment leasing portfolios for October 1, 2011.

EFA: From your perspective, are the leasing companies (which were mostly from Eastern Europe and Central Asia) concerned about the future of the equipment finance industry within their respective countries going into the second half of 2012?

Warner: No, the folks in that region of Europe and Central Asia seem to be very optimistic about their prospects for the rest of the year and going forward. I think they are anticipating continued industry growth fueled by expansion in the transportation sector.

EFA: Do you think that optimism is also related to a belief that the European economy will recover and thrive in the near term?

Warner: That’s a difficult question to answer, but from my perspective, because lease penetration rates are so low in Eastern Europe and Central Asia, the equipment finance market will likely continue to grow, even if these economies slow a bit, including the transportation sector. Their lease penetration levels will probably increase even if the sectors decline due to the sheer need for leasing.

EFA: Did the attendees demonstrate interest in the data created and distributed by ELFA and the Equipment Leasing and Finance Foundation (Foundation) outlined in your presentation?

Warner: There was interest and requests for information about some of the studies put out by the association and foundation. For example, I mentioned some of the studies the foundation conducts in healthcare and other sectors, and there was a lot of interest in how to access those studies. Since my return I have also received numerous emails with requests for this information and I have in turn emailed them the information. So, there is definitely interest in understanding the research being conducted by the association and foundation.

EFA: Have the lessors abroad changed their views and assessments of credit risk underwriting since the economic downturn?

Warner: I think that happened more in Western Europe than in Eastern Europe. Eastern Europe is still more of a “know your customer” environment. There is less dependence on standard underwriting criteria, and more emphasis on knowing the customer. In those regions, lessors regularly go out to meet all their clients. They know the lessees, the people in their families and histories of repayment on prior loans and leases. Also, much of their lending is based upon a lessee’s willingness to pay – the type of information you really can’t find on a credit bureau report. But they do wish to build out more robust credit reporting tools in the region and are working to do so.

EFA: What would you say was your major takeaway from the conference, and did you get a feel for the major takeaways for the attendees who spent time with you?

Warner: What was most impressive to me was the entrepreneurial spirit that these lessors in the region possess. As I mentioned earlier, it reminded me a lot of the U.S. leasing market in the early 1970s when leasing was developing and there were thought leaders figuring out effective go-to-market strategies, and new and effective credit and operational reporting procedures.

I think the attendees learned a lot about the size, scope, robust nature and maturity of the U.S. leasing market.

EFA: If you could summarize the difference between the equipment leasing and finance industry abroad versus in the U.S. today, how would you do so?

Warner: Perhaps the best way to describe it is by saying the issues U.S. lessors are grappling with today are not the growing pains that you experience when you are building an industry as they are doing in Eastern Europe and Central Asia (as well as a number of other regions). In these regions, lessors are experiencing industry growth pains, while the U.S. is experiencing maturity pains.

Adam D. Warner is president of Key Equipment Finance. In this role, he is responsible for all of Key Equipment Finance’s commercial and bank-based equipment lease and finance efforts; as well as equipment finance programs for the aviation, technology, energy, healthcare, specialty vehicle and government vertical market segments. He is also responsible for overseeing the equipment finance programs for all of the company’s vendor customers, including equipment manufacturers and distributors worldwide; and for the company’s advisory and distribution services unit. Warner is currently a vice chair of the Equipment Leasing and Finance Association's board of directors and also serves on the organization's executive committee.

Key Equipment Finance is one of the largest bank-based equipment finance providers in the U.S. The company provides tailored lease and finance solutions for commercial clients and government entities. Through its vendor services unit, equipment finance programs are developed for manufacturers, distributors and resellers in the U.S., Canada and Europe. Key Equipment Finance also provides lease capital markets support for corporations looking to optimize risk and revenue. Additional information regarding Key Equipment Finance can be found online at www.KEFonline.com.

- View Key Equipment Finance Company Profile

- View APN Profile for Adam Warner