Each year the Equipment Leasing and Finance Association and the National Equipment Finance Association bring together finance leaders to share advice on common business issues. While this year’s ELFA and NEFA events have been tabled for now due to coronavirus precautions, the industry will continue meeting online to address key challenges. Industry predictions were calling for modest growth, increased operating expenses and continued margin compression before the outbreak, and now we have the added layer of coronavirus COVID-19 impacts.

Despite tough times, businesses must always look ahead to explore strategies for moving forward. One way for captive finance companies to do this is to “think local” – offering municipal equipment finance to states and local governments. Opportunities for monetization are abundant. Captives already involved in municipal finance can secure more deals and pass the savings to governments through tax-exempt financing. Municipal finance also benefits captives, especially those with local dealerships, by enabling them to make an even greater difference in the communities where they live and work.

Tax-Exempt Financing Is Key

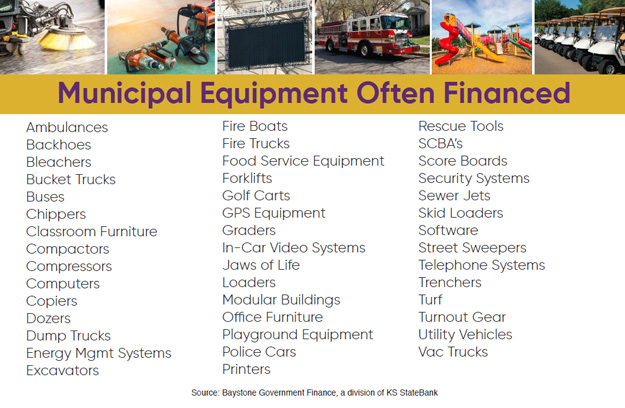

Captives that finance heavy equipment, technology hardware and software, emergency services assets and healthcare equipment are among the prime candidates for municipal financing programs. One example of this is a national heavy/construction equipment captive that tapped outside expertise to build its municipal financing program from the ground up, a program that today generates $11 million to $15 million annually in municipal deals. Captives in a number of other sectors can also succeed in this space. A list of more than 40 different equipment types that are often financed appears at the end of this article.

Based on 28 years’ experience in the field, we strongly advise captives thinking of entering municipal finance, or those already involved in it, to be sure to offer tax-exempt financing. This can be accomplished through an industry partnership with a bank’s government finance division, and it is critically important to the competitiveness of municipal financing programs. Captives who don’t have the ability to offer financing in a non-taxable way are at a disadvantage because the difference in rates can be several percentage points. What’s more, tax-exempt financing is a win-win for all involved, helping state and local governments as well as municipal financing programs.

Which government entities qualify to use tax-exempt financing? Various factors can be used to answer this question, however, generally the answer includes cities, counties, public schools, state and public universities, authorities, special districts, state agencies, townships, fire districts and volunteer fire departments. Keep in mind that this list is not exhaustive and partnering with an institution with extensive experience in the tax-exempt arena would be beneficial in vetting potential entities for tax-exempt treatment.

What About All Those RFPs?

Municipal financing takes a special skill set, along with the ability to meet the varying requirements of localities and states across the nation. It also requires national expertise in all stages of the process.

One critical stage for municipalities that bid out is the request for proposal (RFP) process. To succeed, municipal financing programs must come to the table with ongoing, daily experience putting together proposals, backed by knowledgeable attorneys and staff capable of responding to RFPs. Captives interested in launching or expanding municipal finance programs must either curate these capabilities in-house or team with a government financing partner that already has complementary services and private label programs.

Navigating Ahead

With the real and potential impacts of coronavirus, the equipment finance industry is now in uncharted waters. The key to emerging successfully is to continue looking ahead and to incorporate best practices used to navigate market disruptions and economic downturns of the past.

As you steer your captive equipment finance business through the months to come, consider adding a municipal finance program to help chart additional channels for revenue. If you already have a program in place, tax-exempt financing can take it even further.

There’s another reason to consider municipal equipment financing. Providing equipment financing to state and local governments helps our own communities operate safely and smoothly. Opportunities for the industry to make a difference locally abound, from financing computers that enhance student learning inside and outside classrooms, to the heavy machinery needed for road repairs, to the medical equipment essential for saving lives. It’s deeply rewarding on a personal as well as professional level.